The IRS Tax Exempt & Government Entities Division (TE/GE) recently published its FY 2023 Accomplishments Letter. One segment of customers covered by TE/GE is Exempt Organizations (EO), which includes charities, private foundations, business leagues, labor unions, and veterans’ organizations. The other two segments of customers are Employee Plans and Government Entities. The Accomplishments Letter covers the IRS fiscal year ending September 30, 2023.

TE/GE Snapshot

- Employs 29% of the American workforce

- Controls nearly $53 trillion in assets

- Accounts for about 26% of the $1.5 billion in federal tax expenditures

- TE/GE staffing held relatively steady at about 1,500 permanent staff (541 in EO)

Selected Excerpts from Exempt Organizations Section

Examinations

EO completed examinations of 2,464 filings in fiscal year 2023, including the Form 990 series (990, 990-EZ, 990-PF, 990-N, 990-T) and their associated employment and excise tax returns. Overall, 76% of closed examinations resulted in a tax change (change percentage) and 40% of the examinations were “picked-up” from a related examination (pick-up percentage). We proposed revocations for 141 tax-exempt entities [about 6% of those examined] because of these examinations.

Compliance Strategies

EO continued several compliance strategy examinations to address noncompliance in this sector, including:

- Private benefit and inurement: Focused on organizations that show indicators of potential private benefit or inurement to individuals or private entities through private foundation loans to disqualified persons.

- IRC Section 501(c)(7) entities: Focused on nonmember income generated by exempt recreational and social clubs.

- Form 990-N filing eligibility: Focused on determining if an organization was eligible to file Form 990-N where related filings indicate the organization’s gross receipts aren’t normally $50,000 or less.

The most prominent issues found in compliance strategy examinations relate to filing requirements, for-profit conversions, and self-dealing.

Data-Driven Examinations

Additionally, EO initiated and continued several data-driven compliance examinations, including:

- Organizations selected through compliance query sets based on information reported on Form 990,Returnof Organization Exempt from Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt from Income Tax.

- Organizations identified in collaboration with CI [Criminal Investigation] and RAAS [Research, Applied Analytics, and Statistics] to research indicators of private benefit/inurement.

The most prominent issues found in data-driven examinations relate to employment taxes, unrelated business income, and unreported compensation.

Referrals, Claims and Other Casework

EO also completed other casework vital to protecting the public interest, including:

- Organizations claiming the Employee Retention Credit.

- Organizations referred by both external and IRS sources.

- Organizations engaged in potentially abusive promoter schemes or transactions.

The most prominent issues found in such examinations involve Employee Retention Credit eligibility, employment taxes, filing requirements, and operational requirements related to operating for an exempt purpose.

Determinations

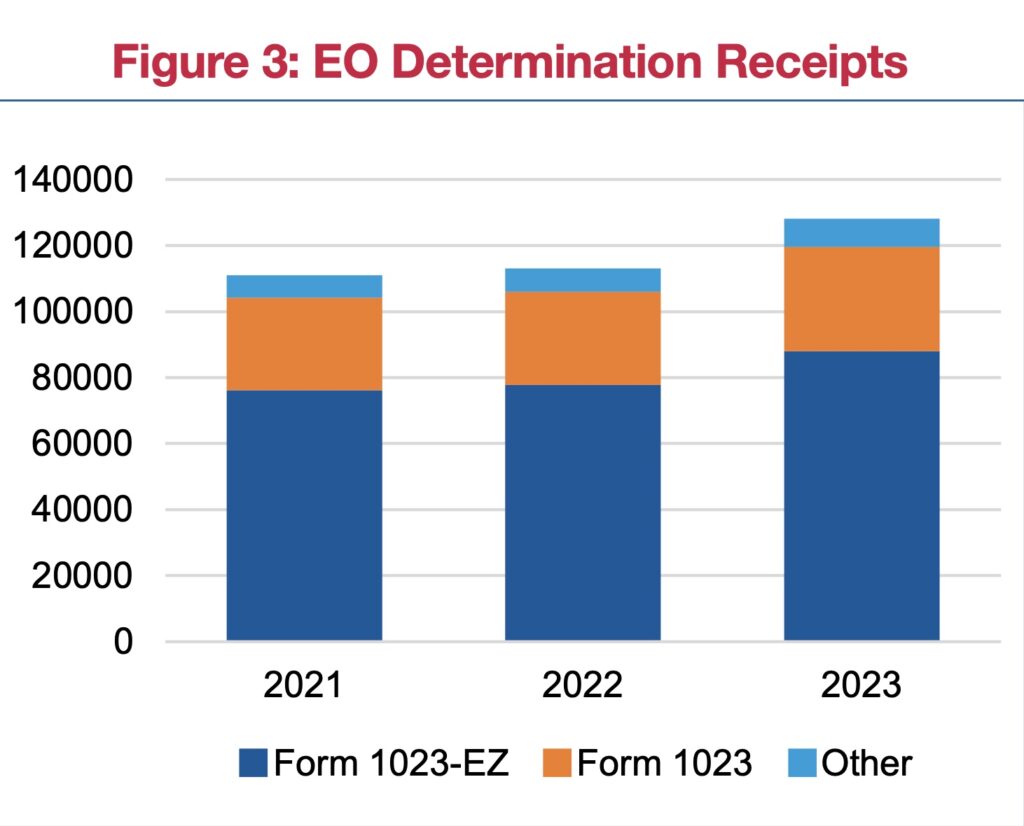

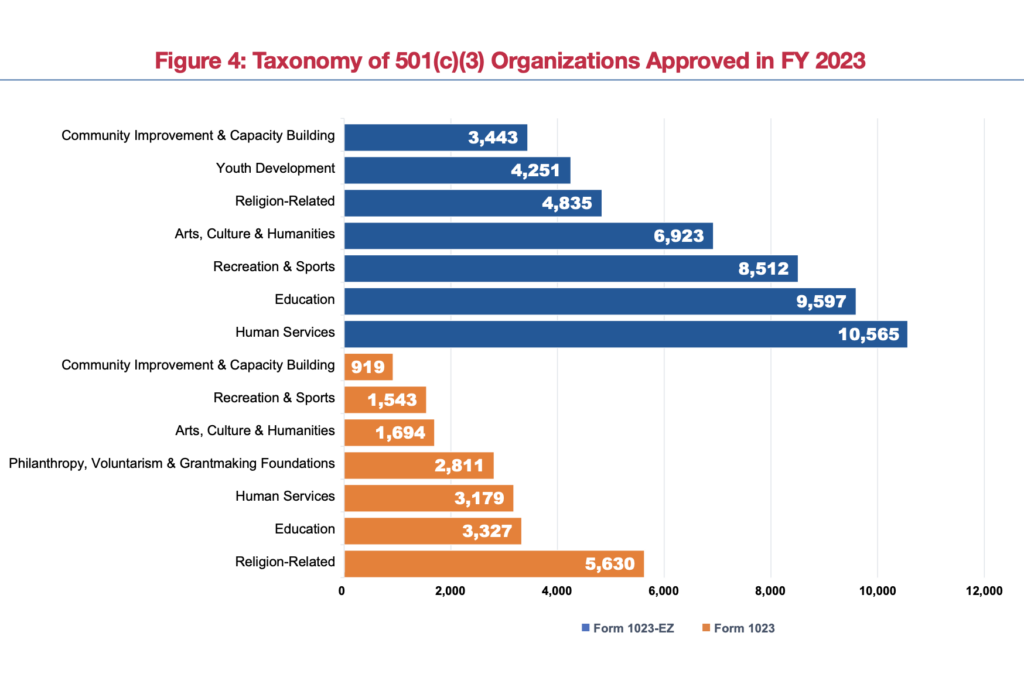

EO closed 119,491 determination applications in fiscal year 2023, including 103,073 approvals, 98,417 of which were approvals for 501(c)(3) status [representing a 95% approval rate].

Compliance Contacts

- TE/GE also continues to review approximately 3,000 tax-exempt hospitals (on a rolling three-year basis) for adherence to IRC Section 501(r). In fiscal year 2023, TE/GE completed 877 reviews which is slightly below our yearly average due to resource limitations.

Additional Resources

IRS TE/GE FY 2024 Program Letter

Tax-Exempt and Government Entities – Annual Priority & Program Letters

You must be logged in to post a comment.