This post on fiscal sponsorship exits follows our first post focused on the selection of a successor and absence of an agreement regarding termination of the relationship between the fiscal sponsor and a Model A project’s leadership. Here, we focus on reasons for the termination that create problems.

Poor Fit

It’s not uncommon for a fiscal sponsor and a particular project’s leadership to discover during the course of their fiscal sponsorship relationship that it’s not working. There may be a poor fit with respect to organizational culture, public image, administrative practices, or risk profiles.

Sometimes, these issues are resolvable. But not always. Understandably, a fiscal sponsor may not be open to making major changes for one project that could impact all of its other projects. And some of the efficiencies gained by fiscal sponsorship may be lost if the fiscal sponsor is spending substantially more time and effort on a project that may not be producing sufficient revenues for the fiscal sponsor’s general fund to offset all of the costs and burdens borne by the fiscal sponsor, particularly if the project’s charitable activities are not producing the types of outputs and outcomes valued by the fiscal sponsor.

The project’s leadership may believe that there is another fiscal sponsor that would be a better fit than its current fiscal sponsor. This may be an issue where the fiscal sponsor doesn’t understand its legal responsibilities. For example, some fiscal sponsors mix Model A and Model C structures in a way that is problematic and where the project’s leadership may have registration, reporting, and tax obligations that it had thought it avoided through the fiscal sponsorship relationship. This may occur where the fiscal sponsor employs project personnel but pays for the project’s costs through an account held under the Employer Identification Number (EIN) associated with the project leadership entity.

Alternatively, the project’s leadership may want to separate from the fiscal sponsor because it believes that the project would best function as an independent nonprofit organization. In such case, the project’s leadership would be well advised to ensure it knows its responsibilities and resource needs for operating as an independent entity. Typically, this means incorporating as a nonprofit corporation, recruiting a board of directors who are each willing and able to meet their fiduciary duties, electing officers, adopting bylaws, registering with the state(s) in which it will operate, adopting appropriate governance and financial management policies, obtaining appropriate insurance, applying for tax-exempt status, and completing a number of annual forms. New nonprofits that have spun off from a strong fiscal sponsor without adequate planning and resources can easily be overwhelmed with all of the items that need to be on their checklists, initially and on an ongoing basis.

Conflict

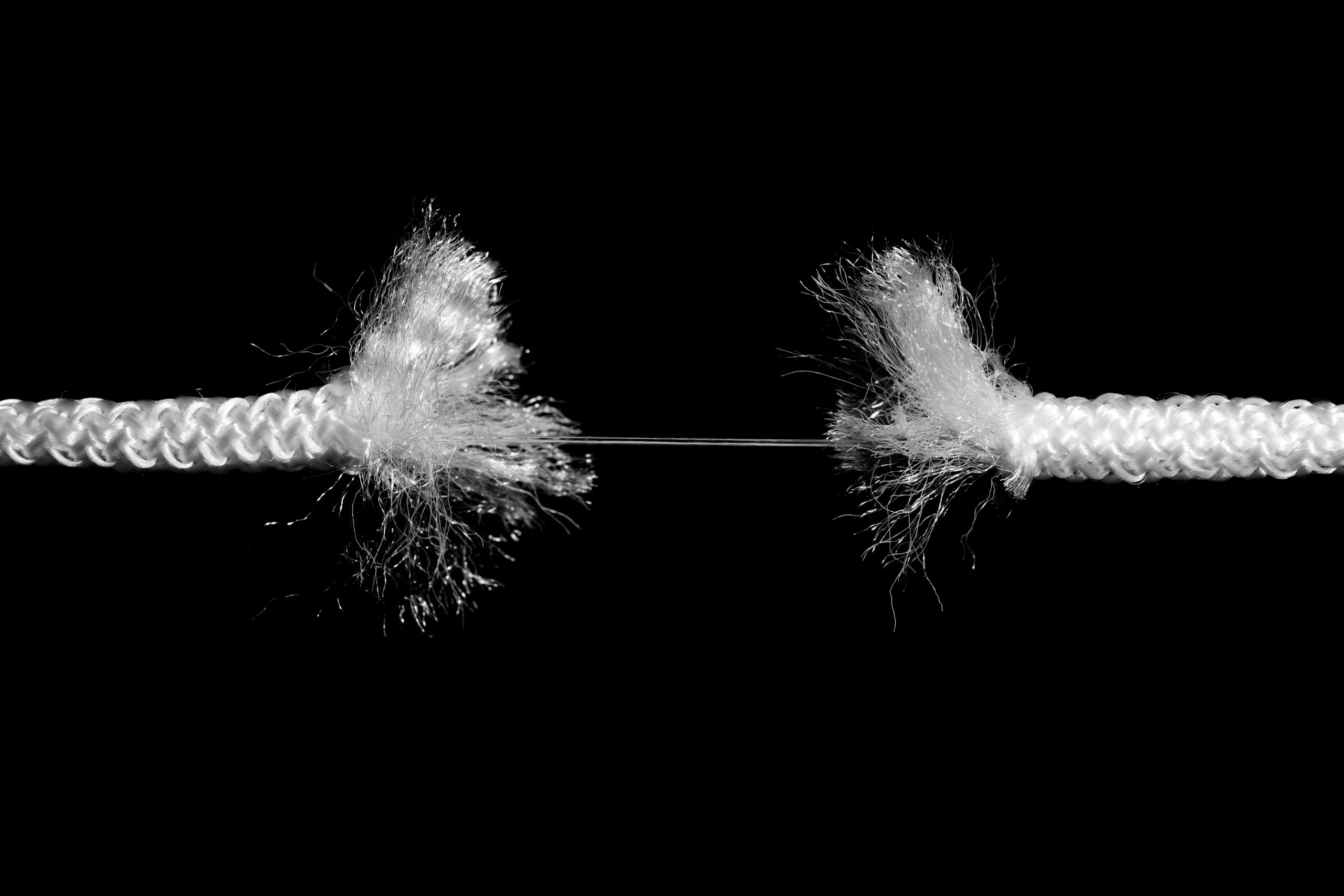

Sometimes, the reason for a desired separation is not merely a poor fit, but a difficult conflict between the parties that jeopardizes one or both parties from effectively and efficiently advancing their missions. There may be issues with communication, reporting, timeliness, compensation, employee benefits, compliance, equity, lobbying, advocacy, donor/funder relations, intellectual property ownership, and/or management and oversight by the fiscal sponsor.

Conflict often results from a misunderstanding by one or both parties of what Model A fiscal sponsorship is and isn’t. This misunderstanding can be amplified by a problematic fiscal sponsorship agreement that takes the form of a type of service agreement rather than an agreement in which the fiscal sponsor has agreed to host and operate a particular charitable program subject to the ultimate management and discretion of the fiscal sponsor’s board of directors.

Conflict may also result from a misunderstanding of the “administrative fee” charged by the fiscal sponsor. This is an intraorganizational fee – meaning that the fiscal sponsor is charging the fee to one of its own restricted funds (the one associated with the project). The fee is not paid by the project leadership entity that entered into the fiscal sponsorship agreement, and it is not separate earned revenue item for the fiscal sponsor. For more on this issue, please see Fiscal Sponsorship: Fees (Model A).

Breach of Agreement

Where the conflict is over a breach of the fiscal sponsorship agreement, the parties must determine whether there is a reasonable cure and opportunity to repair the relationship or an absence of trust and good faith that makes reconciliation highly improbable. Of course, whether there has been a breach of agreement may be part of the conflict.

From the fiscal sponsor’s perspective, a material breach of the agreement might arise from, among other things, the following actions of a project’s leadership:

- misrepresentations to prospective donors and funders including regarding the legal entity making the solicitation (i.e., the fiscal sponsor, not any separate entity associated with the project’s leadership);

- misrepresentations to the fiscal sponsor of the project’s activities and leadership;

- mismanagement of the project’s operations, including but not limited to human resources, spending, facilities, intellectual property assets, privacy, programs, and events;

- failure to report financial information in a timely manner; and

- creation of contractual relationships with third parties without due authorization of the fiscal sponsor

From the perspective of the project’s leadership, a material breach of the agreement might arise from, among other things, the following actions of the fiscal sponsor:

- misuse of restricted funds associated with the project’s specific purposes for other purposes (excluding any legitimate transfers of restricted funds as part of the intraorganizational administrative fees agreed upon);

- failure to qualify to do business and/or register in states and jurisdictions in which the project is operating, assuming such plans were disclosed and appropriate representations were made in the agreement;

- other misrepresentations to the project’s leadership of the fiscal sponsor’s capabilities to sponsor the project, if made in the agreement; and/or

- noncompliance with any reporting or accountings required under the agreement or the fiscal sponsor’s policies incorporated by the agreement.

Resolving an assertion of breach of contract by one or both parties will often require knowledgeable attorneys who can not only interpret the agreement, but also understand the context and overlay of IRC Section 501(c)(3) and state nonprofit and charitable trust laws. The parties also need to understand what remedies are available and the limitations and problems that may be associated with certain contemplated remedies. For example, a project’s leadership may not have a right to claim control of charitable assets without a charitable entity. And a fiscal sponsor that terminates the relationship may still be stuck with all of the project’s obligations.

No solution will avoid all risks so the parties should consider what the best resolution would be with appropriate consideration of risks and a focus on mission, values, vision, and ecosystem.