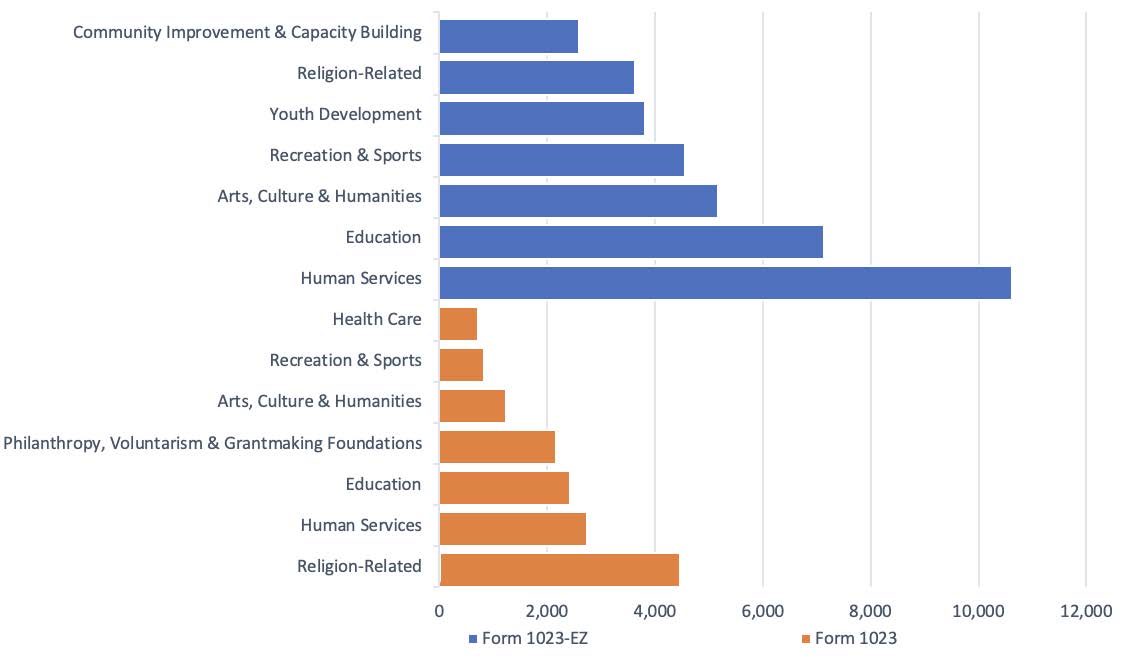

Figure 4: Taxonomy of 501(c)(3) Organizations Approved in FY 2021

A startup nonprofit wishing to apply for IRS recognition of tax-exemption under 501(c)(3) must file either Form 1023 or Form 1023-EZ. The Form 1023-EZ is only available to organizations that meet certain eligibililty requirements, including projection of gross revenues of no greater than $50,000 in any of the next three years. A Form 1023-EZ Eligibility Worksheet available on page 13 of the Instructions for Form 1023-EZ must be completed before filing a Form 1023-EZ.

According to the IRS, “[u]se of Form 1023-EZ has grown since its introduction in 2014, and the TE/GE division of the IRS continues its efforts to collect, monitor and evaluate data to understand the impact and opportunities from this important change to its determination process.” From the Tax Exempt and Government Entities Fiscal Year 2021 Accomplishments Letter, it appears that the Form 1023-EZ was used in close to 75 percent of all exemption applications in fiscal year 2021 (ending September 30, 2021).

The Form 1023-EZ has faced strong criticism from many exempt organizations practitioners, state charities regulators and the National Association of State Charity Officials (NASCO), the Taxpayer Advocate (an independent organization within the IRS), and some high profile national nonprofits like the National Council of Nonprofits largely because the Form offers little information for an examiner to substantively review beyond a mission statement, NTEE Code, and several check boxes. Nevertheless, the benefits of quicker processing times and clearance of an unacceptable backlog of applications have led the IRS to defend continued use of the Form 1023-EZ with some minor changes (e.g., 2021 Memorandum).

But the ease provided by Form 1023-EZ for a founder intentionally or unintentionally to get 501(c)(3) status for an organization that does not qualify is alarming. And for startups that plan on seeking funds from foundations, there may be a time when these funders consider use of the Form 1023-EZ a strike against a grant applicant since it likely heightens their due diligence requirements since the IRS has severely reduced its review.

The criticism of Form 1023-EZ continues to grow louder …

Letter to IRS Commissioner from Chair of House Oversight Subcommittee About IRS Processing of 501(c)(3) Exemption Applications

July 20, 2022

Dear Commissioner Rettig,

I write today with urgency regarding a recent article in The New York Times about the haphazard approval process for tax-exempt organizations described in Section 501(c)(3) of the Internal Revenue Code.[1] The article states that a “convicted stock market fraudster” successfully applied for tax exemptions for 76 phony nonprofit charities, many of which used names almost indistinguishable from well-known nonprofits. Fifty-six of the approved fraudulent organizations applied using Internal Revenue Service (IRS) Form 1023-EZ, which requires minimal information from applicants. This should never have happened.

Although Form 1023-EZ was developed to curtail an increasing backlog of exempt organization applications, it seemingly led to fraudulent applications being approved with lax oversight by the IRS. A 2019 study by the Taxpayer Advocate Service found that 46% – nearly half – of approved applicants did not actually pass the “organizational test” required by statute to establish legitimacy as a charitable organization.[2] Once approved, bogus charities scam unwitting donors who trust IRS-certified 501(c)(3) organizations to be properly vetted and legitimate. The IRS has failed these citizens.

To help the Ways and Means Subcommittee on Oversight better understand how the IRS processes applications for tax exemption, please provide answers to the following questions by August 3, 2022:

- For both Forms 1023-EZ and Forms 1023, please provide the following: (a) the number of applications received each year since 2015; (b) the number of applications approved; (c) the number of applications rejected; (d) the number of applications returned for additional information that then provided such information; and (e) the number of applications returned for additional information that failed to provide such information.

- Describe the procedures for processing Forms 1023-EZ, including who reviews the application, the average amount of time (number of hours) to review the application, and the number of days, on average, from receipt to IRS’s determination. What steps are taken when there is suspected fraud?

- Describe the current oversight of the tax-exempt organization application process. What happens with respect to an application when the IRS is notified of concerns by individuals, the media, law enforcement, state tax agencies, or other organizations?Additionally, I request a briefing for my staff on this issue and expect your prompt attention

to this matter.

Sincerely,

1 David Fahrenthold, Troy Olson, and Julie Tate, 76 Fake Charities Shared a Mailbox. The I.R.S. Approved Them All, The New York Times (July 3, 2022), https://www.nytimes.com/2022/07/03/us/politics/irs-fake- charities.html.

2 Taxpayer Advocate Service, Study to the Extent to Which the IRS Continues to Erroneously Approve Form 1023-EZ Applications (Jan. 8, 2020), https://www.taxpayeradvocate.irs.gov/wp content/uploads/2020/11/ARC19_Volume1_TRRS_04_StudyExtent.pdf.