A 501(c)(3) organization is presumed to be a private foundation unless it qualifies as a public charity. As discussed in a previous post and on our short YouTube clip, public charity classification is generally far more advantageous due to the burdensome rules and restrictions applicable to private foundations. Most 501(c)(3) organizations...

Nonprofit Tweets of the Week – 3/27/15

TED 2015: Truth and Dare was held in my hometown of Vancouver from March 16-20. Have a listen to tween pianist Joey Alexander (featured at TED) perform Giant Steps while perusing our curated nonprofit tweets of the week: Gene: Read Erin Bradrick‘s Basic Legal Considerations Before Launching a Planned-Giving Program in The...

Private Foundations & Self-Dealing

We recently added a post to the blog about private foundations and the rules that they are subject to. Of the private foundation rules, those regarding self-dealing are some of the most complex and have some of the most serious potential ramifications for a private foundation if violated. In...

Nonprofit Tweets of the Week – 3/20/15

This week I had the pleasure of attending the Wharton Social Impact Conference (see Storify). Have a listen to Ramy Essam‘s Irhal (anthem of the Egyptian protests in Tahrir Square) while perusing our curated nonprofit tweets of the week: La Piana Consulting: 6 assumptions + 3 critical uncertainties = 9 key trends affecting...

NEO Law Group’s Video on Tips for Nonprofits: Private Foundation or Public Charity?

Yesterday, NEO Law Group released a new short video in its series of videos on tips for nonprofits, available on YouTube. This video focuses on the differences between private foundations and public charities. We hope that you enjoy it and please stay tuned for additional videos from NEO Law Group on tips for nonprofits.

Independent Sector’s Principles for Good Governance

The legal duties of a board member go beyond ensuring that the organization complies with applicable law. A board member must act with reasonable care and good faith in the best interests of the organization. The best interests of a 501(3)(3) organization are related to its performance of its charitable, educational,...

Nonprofit Tweets of the Week – 3/13/15

I’m in Washington DC today to attend a meeting of the Independent Sector Public Policy Committee. Appropriately, the past week was marked by the 50th Anniversary of Bloody Sunday in Selma and International Women’s Day. Have a listen to David Bowie‘s Changes while perusing our curated nonprofit tweets of the week:...

Private Foundation Rules

A Section 501(c)(3) exempt organization is presumed to be a private foundation unless it qualifies as a public charity. The distinction between the private foundation and public charity classification may be critical for organizational leaders to understand, as public charity status is generally far more advantageous when there is...

Nonprofit Tweets of the Week – 3/6/15

This week, the Department of Justice released a report of its investigation of the alleged civil rights abuses and other acts of misconduct by the police department in Ferguson. Have a listen to The Game‘s Don’t Shoot while perusing our curated nonprofit tweets of the week: HuffPost Politics: The problem is way...

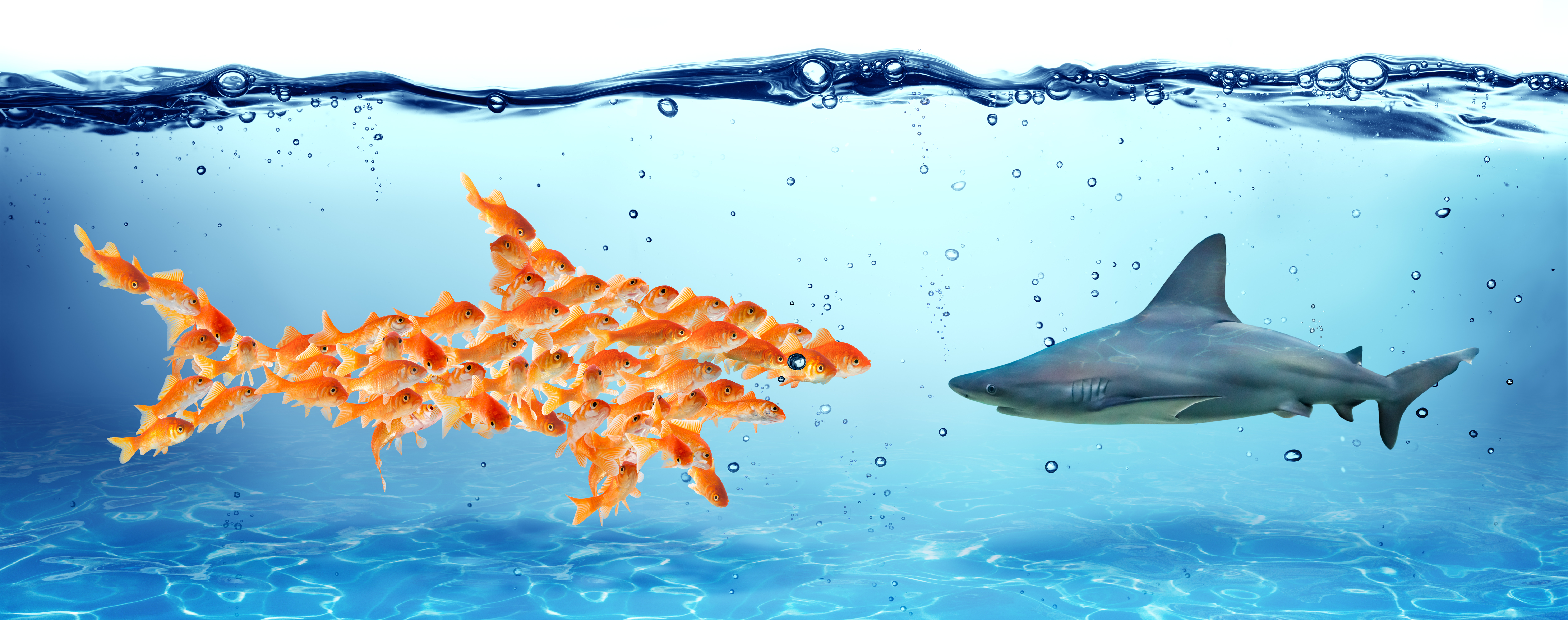

Nonprofit Collaborations: The Structural Options

A recent article in The Nonprofit Quarterly titled “Collaborations: The Nonprofit Trend” discussed the movement towards collaborations and linkages of many kinds among nonprofits to combat a growing need for services with fewer resources. While there is no denying the importance of collaborations for many organizations, and particularly to...

You must be logged in to post a comment.