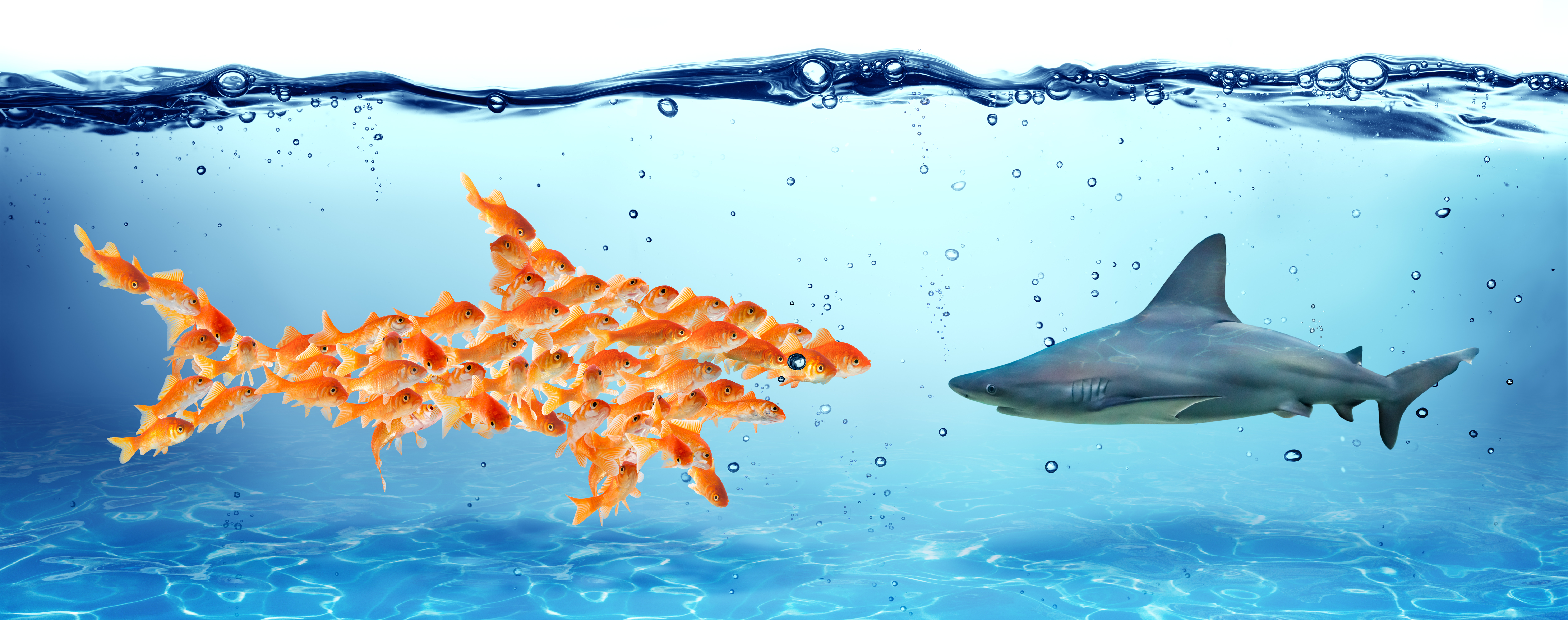

A recent article in The Nonprofit Quarterly titled “Collaborations: The Nonprofit Trend” discussed the movement towards collaborations and linkages of many kinds among nonprofits to combat a growing need for services with fewer resources. While there is no denying the importance of collaborations for many organizations, and particularly to tackle larger social problems, leaders of nonprofits should have a basic understanding of the legal structures possible before entering into these collaborations.

MOU or Contract

An organization should determine at the outset whether it wants to enter into an enforceable agreement with another party or just a mutual set of understandings where neither party is legally responsible for complying with the terms.

If an enforceable agreement is desired, the parties should enter into a written contract that clearly states each party’s obligations and promises to the other party. The contract should also address the term of the agreement and how the contract may be terminated.

A memorandum of understanding or MOU may be appropriate where the parties don’t want an enforceable agreement. But organizations must be very careful about the drafting of an MOU if they don’t want it to be legally binding. An MOU can easily turn into a contract by virtue of the words regardless of what the document is called. Adding to the confusion, it’s common among nonprofits to call a contract an MOU because it sounds more friendly and collaborative. Generally, this isn’t a good idea because it may result in misunderstandings between the parties about what each party wants in the event the other party doesn’t perform.

Service Agreement

A simple form of collaboration is one in which one party provides services to another party in exchange for money or some other form of consideration (value). For example, a nonprofit research firm might provide its research services to a nonprofit service provider in a way that benefits both parties and furthers their respective missions. The research firm gets paid to do research that may have valuable application the firm itself is not designed to pursue. The service provider gets to use the research it is not designed to conduct to better serve its intended beneficiaries.

Mutual Service Agreement

A service agreement may be a little more complicated and involve a deeper form of collaboration where each party commits to performing services without a transfer of money from one party to the other. The services may also be directed towards a common class of beneficiaries rather than to each other. For example, several nonprofits supporting healthy families but focused on different aspects (e.g., domestic violence, child abuse, mental health) may enter into an agreement to provide their respective services in a coordinated fashion or perhaps at a common center.

License Agreement

A license agreement generally provides for one party’s right to use certain intellectual property of another party. Intellectual property includes trademarks/service marks (e.g., names, logos), copyright (e.g., writings, music, art, film), patents (e.g., inventions, designs), and trade secrets (e.g., mailing lists). A nonprofit might license use of its name and logo in connection with its support of an event or use of its film to allow for broader viewership and revenue-generation.

Resource-Sharing Agreement

A resource-sharing agreement can facilitate the sharing of office space, equipment, and even employees for greater efficiencies. Such agreements are common with smaller affiliated nonprofits like a 501(c)(3) public charity and related 501(c)(4) social welfare organization but can involve otherwise unrelated organizations too. Resource-sharing agreements should specifically detail what resources are to be shared and how the costs will be allocated to each party. Generally, a 501(c)(3) organization party to such an agreement must ensure that it is not paying more than fair market value in the arrangement if it involves a non-501(c)(3) party, and particularly if it is making any form of payment to a for-profit. Resource-sharing agreements can trigger many issues involving leases, insurance, licenses, permits, employees, and independent contractors. So, nonprofits must enter into these agreements with great care.

Fiscally Sponsored Collaborative

Nonprofits seeking to create a deep collaboration but only on one particular program (and not their entire operations) may find it advantageous to use a third party fiscal sponsor. By establishing the collaborative within a fiscal sponsor, the parties may be able to collaborate without worrying as much about control and liability issues. The fiscal sponsor would own and ultimately be responsible for the project, but the parties could each assign individuals to collectively serve as the steering committee to the project. Such arrangements are quite common among funders who may look to pool their grants and leverage other resources to focus on a specific issue area while minimizing some of the administrative burdens of their grantees.

“Partnership”

For nonprofits pursuing a deep collaboration on one particular program that do not want to use a third party fiscal sponsor, creation of some form of “partnership” may be a viable alternative. A true partnership would be owned by the two parties, and each party would be jointly and severally liable for any liabilities of the partnership. A limited liability company (LLC), including a low-profit limited liability company (L3C), would be owned by the two parties but could be structured so that liabilities of the LLC would not normally ascend to the owners. A for-profit corporation, including a benefit corporation or social purpose corporation, would be owned by the two parties and would similarly provide its owners with the protection of limited liability. A nonprofit corporation, which has no owners, would be governed by a board appointed by the two parties, who might retain other rights (e.g., the rights of a voting member) with respect to the corporation. The choice of entity to house the collaborative effort should be made carefully and preferably with the assistance of appropriate counsel.

Cross-Sector Joint Venture

Nonprofits may want to enter into joint ventures with for-profits to raise capital, to access the expertise possessed by their for-profit co-venturers, and to take advantage of opportunities otherwise unavailable to them. For-profits may want to enter into joint ventures with nonprofits to access new sources of capital, to exploit specific assets owned by the nonprofit (such as intellectual property rights), to take advantage of available tax credits (such as the federal Low-Income Housing Tax Credit), and to acquire greater community or political support. As is the case with the “partnership” option discussed above, the choice of entity to house the joint venture should be made carefully. Among the issues to manage unique to nonprofits are:

- the operational test issues (e.g., substantial unrelated business activities attributed to the nonprofit co-venturer from a pass-through joint venture – like an LLC – could jeopardize its 501(c)(3) status); and

- the control issues (e.g., the nonprofit must retain control of the charitable activities of the joint venture and must have the right to appoint at least half of the board of a corporate joint venture entity).

Merger

A merger is sometimes referred to as the ultimate collaboration of two parties. In the most typical form of merger, the corporation that remains in existence is referred to as the surviving corporation and the corporation that is merged out of separate legal existence is referred to as the disappearing corporation. In a merger, the surviving corporation inherits not only all of the assets of the disappearing corporation(s), but also all of its liabilities and obligations. Accordingly, it becomes extremely important for the parties to engage in thorough due diligence prior to an agreement to merge.

Mergers are complex transactions that generally require negotiation over matters such as the addition of board members from the disappearing corporation to the board of the surviving corporation, preservation of certain programs previously run by the disappearing corporation, and decisions on which, if any, employees of the disappearing corporation will continue as employees of the surviving corporation. Particularly if the parties were not sufficiently prepared, a merger can result in many potentially unanticipated consequences such as real property transfer taxes, breaches of contracts (e.g., for failure to notify the other party of the merger), and loss of future planned gifts.

As for cost savings, don’t expect that at the outset and maybe not at all. The costs of a merger, including all of the due diligence, preparation, and integration activities, can be very substantial.

But a merger entered into thoughtfully and with diligence can result in tremendous benefits, most notably, an increase in the efficiency and effectiveness of advancing the missions of both organizations and a stronger organization to conduct the charitable activities that further the combined mission. More specifically, a merger may increase the ability of the organizations to expand their service area, their programs, and their internal capacity to create new and better ways to further their mission.

Concluding Thoughts

We often hear the expression – “Trust, but verify.” The same wisdom applies to collaborations. Verify, exercising reasonable care in the process, that your collaborator is trustworthy and is capable of pursuing your common goals and meeting all of its obligations. And protect yourself, to a reasonable extent, in the event your collaborator doesn’t meet its obligations.